Lifetime Access Opportunity

Create Your Own Algorithmic Trading Strategy Without Coding

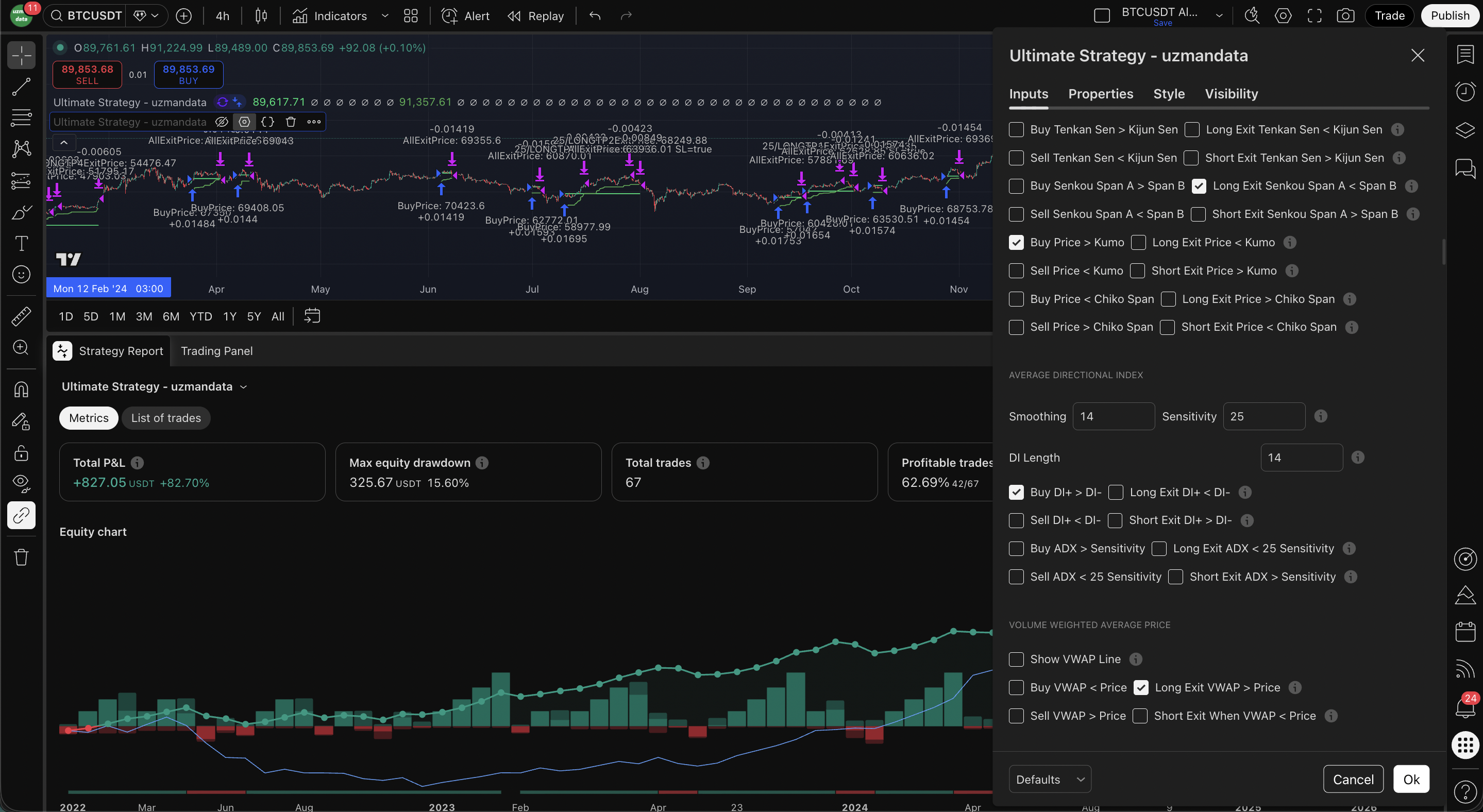

Design your buy-sell rules on TradingView in seconds. Backtest your strategy to see historical performance, verify profitability.

Instantly execute automate trades via direct broker integration.

✅ Automated Trading 🔒 Direct Execution 🚀 TradingView Integration

10.000+

Strategies Tested

3000+

Active Traders

100%

TradingView Compatible

24/7

Market Monitoring

Test the Past Before Risking Your Cash

See exactly how much your strategy would have earned in the past, its success rate, and maximum drawdown in seconds. Don't waste time and money on failing strategies.

Only automate the winning formulas.

Unlimited Strategies in One Indicator

Moving Averages (MA), RSI, MACD, Bollinger Bands, and many more... Manage dozens of technical indicators from a single panel. Combine the conditions you want using a simple "Click-and-Select" method.

Even when your computer is off, your strategy continues to run 24/7 via TradingView alerts.

Show Moving Average Plots

MA Type

MA#1 Length (Longer)

MA#2 Length (Shorter)

Buy MA#2 > MA#1 Long Exit MA#2 Less Than MA#1

Sell MA#2 Less Than MA#1 Short Exit MA#2 > MA#1

Show Moving Average Plot

MA Type

MA Length

Buy Price > MA Long Exit Price > MA

Buy Price Less Than MA Long Exit Price Less Than MA

Sell Price > MA Short Exit Price > MA

Sell Price Less Than MA Sell Exit Price Less Than MA

Buy Any of Last 5 Candle Less Than MA

Sell Any of Last 5 Candle > MA

Show Moving Average Plot

MA Type

MA Length

Buy Price > MA Long Exit Price > MA

Buy Price Less Than MA Long Exit Price Less Than MA

Sell Price > MA Short Exit Price > MA

Sell Price Less Than MA Short Exit Price Less Than MA

Buy Any of Last 5 Candle Less Than MA

Sell Any of Last 5 Candle > MA

Percent

Activate Buy Condition Activate Long Exit Condition

Activate Sell Condition Activate Short Exit Condition

Lookback

Overbought

Oversold

Buy RSI Less Than Oversold Long Exit RSI > Overbought

Sell RSI > Overbought Short Exit RSI Less Than Oversold

Buy RSI > Oversold Long Exit RSI Less Than Overbought

Sell RSI Less Than Overbought Short Exit RSI > Oversold

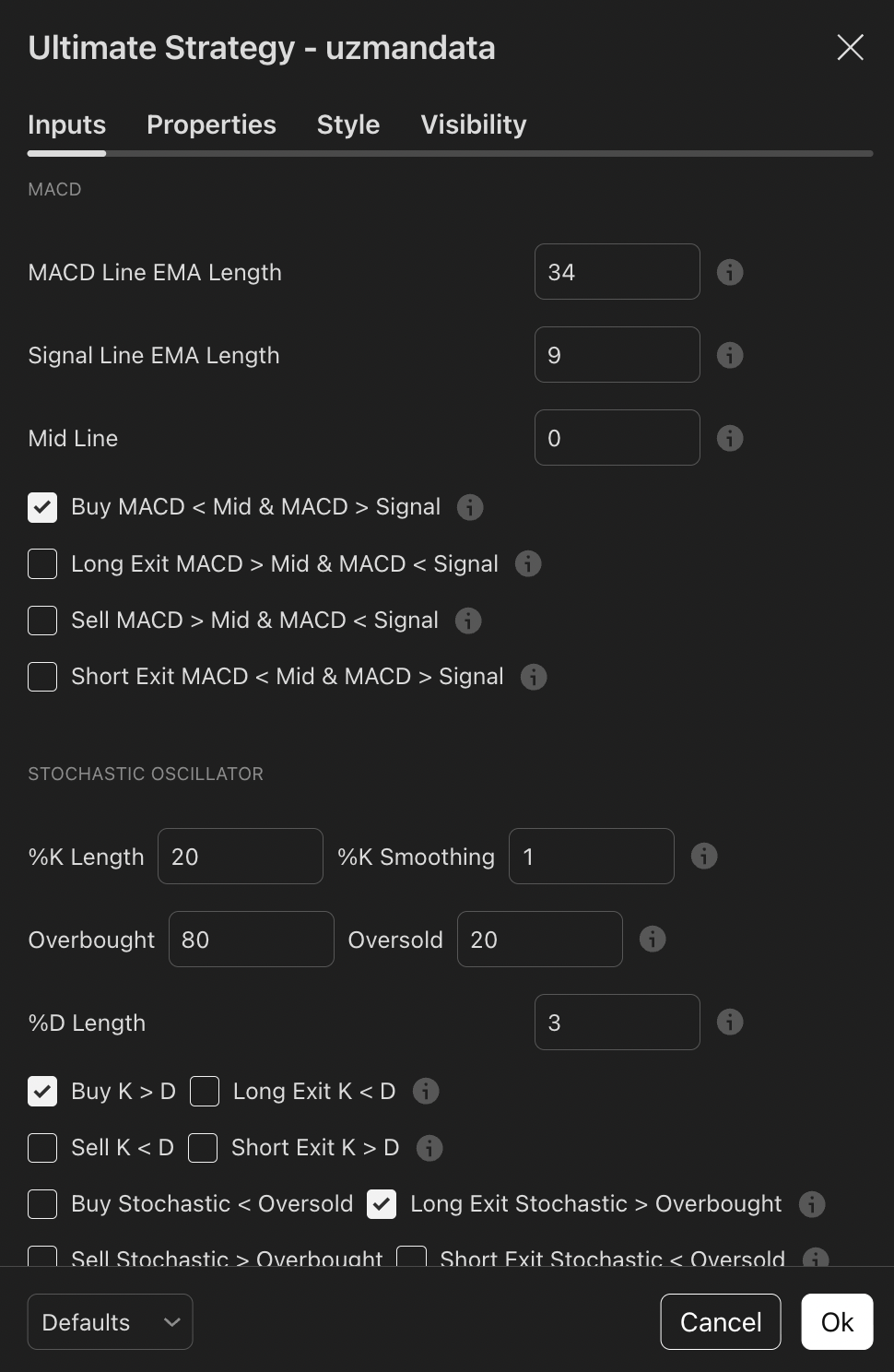

MACD Line EMA Length

Signal Line EMA Length

Mid Line

Buy MACD Less Than Mid & MACD> Signal

Long Exit MACD > Mid & MACD Less Than Signal

Sell MACD > Mid & MACD Less Than Signal

Short Exit MACD Less Than Mid & MACD > Signal

%K Length

%K Smoothing

%D Length

Overbought

Oversold

Buy K > D Long Exit K Less Than D

Sell K Less Than D Short Exit K > D

Buy Stochastic Less Than Oversold Long Exit Stochastic > Overbought

Sell Stochastic > Overbought Short Exit Stochastic Less Than Oversold

Show Bollinger Line and Bands

Source

Length

Offset

Band Multiplier

Prev. Bar Count

Buy Price Less Than Baseline Long Exit Price > Baseline

Sell Price > Baseline Short Exit Price Less Than Baseline

Buy Price > Baseline Long Exit Price Less Than Baseline

Sell Price Less Than Baseline Short Exit Price > Baseline

Source

Length

Dev

Buy Price Less Than Lowerline Long Exit Price > Upperline

Sell Price > Upperline Short Exit Price Less Than Lowerline

Show Ichimoku Line and Bands

Conversion Line (Tenkan Sen) Length

Base Line (Kijun Sen) Length

Leading (Senkou) Span B Length

Lagging (Chiko Sen) Span

Buy Price > Tenkan Sen Long Exit Price Less Than Tenkan Sen

Sell Price > Tenkan Sen Short Exit Price Less Than Tenkan Sen

Buy Price > Kijun Sen Long Exit Price Less Than Kijun Sen

Sell Price > Kijun Sen Short Exit Price Less Than Kijun Sen

Buy Tenkan Sen > Kijun Sen Long Exit Tenkan Sen Less Than Kijun Sen

Sell Price > Tenkan Sen Short Exit Price Less Than Tenkan Sen

Buy Senkou Span A > Span B Long Exit Senkou Span A Less Than Span B

Sell Senkou Span A > Span B Short Exit Senkou Span A Less Than Span B

Buy Price > Kumo Long Exit Price Less Than Kumo

Sell Price > Kumo Short Exit Price Less Than Kumo

Buy Price > Chiko Span Long Exit Price Less Than Chiko Span

Sell Price > Chiko Span Short Exit Price Less Than Chiko Span

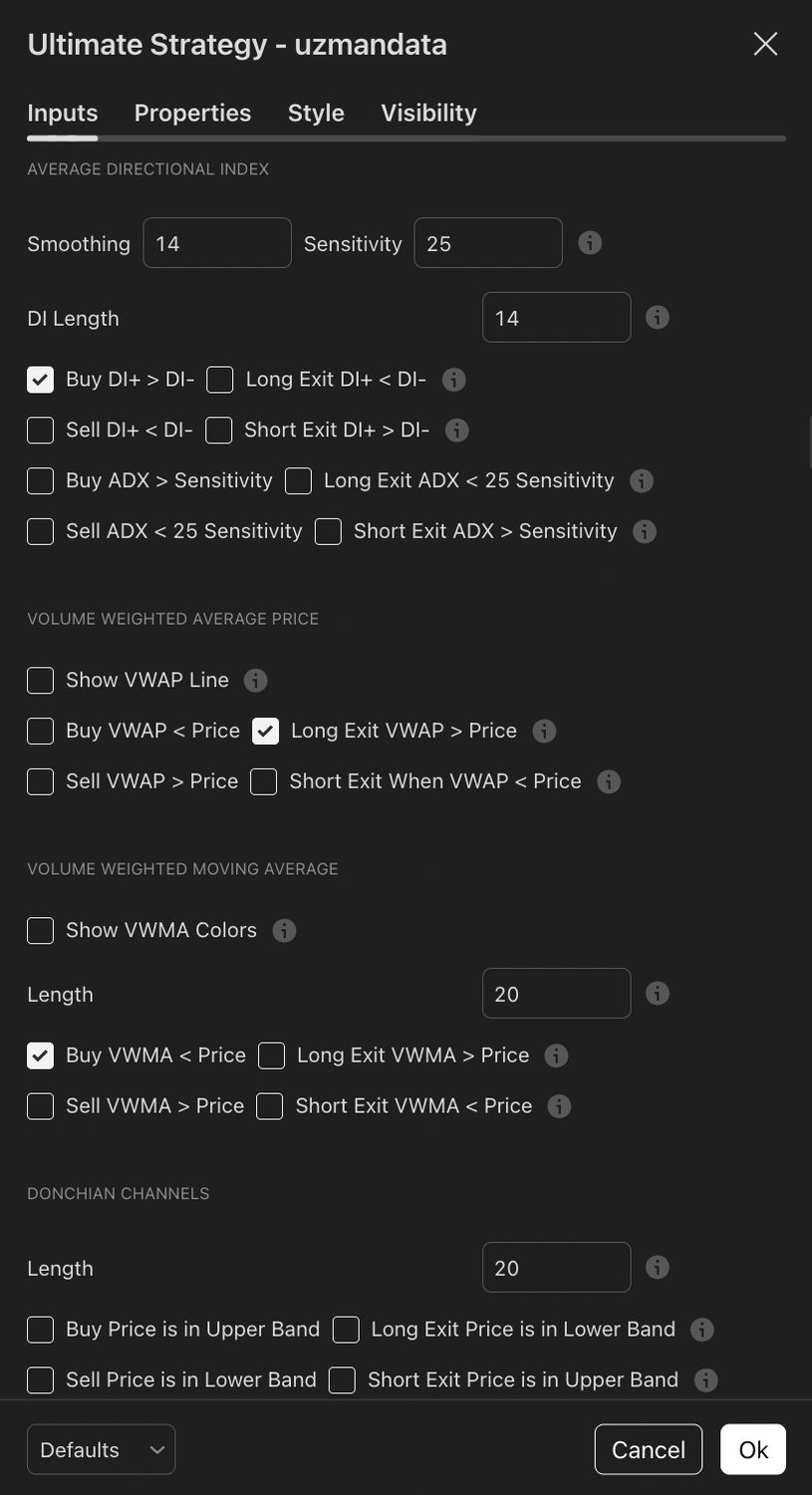

ADX Smoothing

DI Length

ADX Sensitivity

Buy DI+ > DI- Long Exit DI+ Less Than DI-

Sell DI+ Less Than DI- Short Exit DI+ > DI-

Buy ADX > Sensitivity Long Exit ADX Less Than 25 Sensitivity

Sell ADX Less Than 25 Sensitivity Short Exit ADX > Sensitivity

Show VWAP Line

Buy VWAP Less Than Price Long Exit VWAP > Price

Sell VWAP > Price Short Exit VWAP Less Than Price

Show VWMA Colors

Buy VWMA Less Than Price Long Exit VWMA > Price

Sell VWMA > Price Short Exit VWMA Less Than Price

Show Donchian Bands

Length

Buy Price is in Upper Band Long Exit Price is in Lower Band

Sell Price is in Lower Band Short Exit Price is in Upper Band

BB Length

BB MultiFactor

KC Length

KC MultiFactor

V2 MA Signal Period

Buy Momentum = Green Long Exit Momentum = Red

Sell Momentum = Red Short Exit Momentum = Green

Buy Momentum > MA Long Exit Momentum Less Than MA

Sell Momentum Less Than MA Short Exit Momentum > MA

Show SuperTrend Plots

ATR Periods

Source

ATR Multiplier

Buy Trend = Green Long Exit Trend = Red

Sell Trend = Red Short Exit Trend = Green

Show SuperTrend Plots

ATR Periods

Source

ATR Multiplier

Buy Trend = Green Long Exit Trend = Red

Sell Trend = Red Short Exit Trend = Green

Multiplier

Common Period

Source

No Volume Data?

Activate Buy Condition Activate Long Exit Condition

Activate Sell Condition Activate Short Exit Condition

Source

Period

Percent

MA Type

Activate Buy Condition Activate Long Exit Condition

Activate Sell Condition Activate Short Exit Condition

Show MavilimW Colors

First Moving Average

Second Moving Average

Buy MavilimW = Blue Long Exit MavilimW = Red

Sell MavilimW = Red Short Exit MavilimW = Blue

T3 Length

Volume Factor

T3 Length Fibo

Volume Factor Fibo

Activate Buy Condition Activate Long Exit Condition

Activate Sell Condition Activate Short Exit Condition

Source

Fast Period

Fast Range

Slow Period

Slow Range

Activate Buy Condition Activate Long Exit Condition

Activate Sell Condition Activate Short Exit Condition

Length

Signal Length

Source

Overbought Level

Oversold Level

Buy MFI in Rising Trend Long Exit MFI in Falling Trend

Sell MFI in Falling Trend Short Exit MFI in Rising Trend

Buy MFI Less Than Oversold Long Exit MFI > Overbought

Sell MFI > Overbought Short Exit MFI Less Than Oversold

Show Kaufman Colors

Length

Fast Length

Slow Length

Source

Buy Kaufman = Green Long Exit Kaufman = Red

Sell Kaufman = Red Short Exit Kaufman = Green

CCI Length

CCI Source

MA Type

MA Length

Overbought

Oversold

Buy CCI Less Than Oversold Long Exit CCI Higher Than Overbought

Sell CCI Higher Than Overbought Short Exit Less Than Oversold

Buy CCI Less Than Overbought Long Exit CCI Higher Than Oversold

Sell CCI Higher Than Oversold Short Exit Less Than Overbought

Buy CCI Higher Than MA Long Exit CCI Less Than MA

Sell CCI Less Than MA Short Exit Higher Than MA

Length

Activate Buy Condition Activate Long Exit Condition

Activate Sell Condition Activate Short Exit Condition

Channel Length

Average Length

Buy Wave 1 > Wave 2 Long Exit Wave 1 Less Than Wave 2

Sell Wave 1 Less Than Wave 2 Short Exit Wave 1 > Wave 2

Highs Source

Lows Source

Max Range

Noise Reduction

Buy on Support Long Exit on Resistence

Sell on Resistence Short Exit on Support

Length

Buy RVI in Rising Trend Long Exit RVI in Falling Trend

Sell RVI in Falling Trend Short Exit RVI in Rising Trend

Long Entry Long Exit

Short Entry Short Exit

Activate Buy Condition Activate Long Exit Condition

Activate Sell Condition Activate Short Exit Condition

#1 Candle Count

#1 Candle Color

#1 Percent Change %

#1 Activate Buy Condition #1 Activate Long Exit Condition

#1 Activate Sell Condition #1 Activate Short Exit Condition

#1 Activate Buy Higher High #1 Activate Long Exit Lower Low

#1 Activate Sell Lower Low #1 Activate Short Exit Lower Low

#2 Candle Count

#2 Candle Color

#2 Percent Change %

#2 Activate Buy Condition #2 Activate Long Exit Condition

#2 Activate Sell Condition #2 Activate Short Exit Condition

#2 Activate Buy Higher High #2 Activate Long Exit Lower Low

#2 Activate Sell Lower Low #2 Activate Short Exit Lower Low

Show Min Max Bands

Show Bar Volatility

Show Volatility Table

Show Max Drawdown

Candle Count for MinMax Bands

Long %

Short %

Candle Change High Value %

Candle Change Low Value %

Candle Count for Max Drawdown

Buy MinBand Condition Sell MinBand Condition

Buy MaxBand Condition Sell MaxBand Condition

Long Exit MinBand Condition Long Exit MaxBand Condition

Short Exit MinBand Condition Short Exit MaxBand Condition

Activate NASDAQ Correlation

NASDAQ Daily Price Changes %

Activate BITO Correlation

BITO Daily Price Changes

Buy Daily Candle = Green Long Exit Daily Candle = Red

Sell Daily Candle = Red Short Exit Daily Candle = Green

Futures Entry Date

Futures Exit Date

Exact Date?

Futures Buy = Entry Date Futures Long Exit = Exit Date

Futures Sell = Entry Date Futures Short Exit = Exit Date

Activate Base Entity

Base Entity

Base Percent Change %

Base Price Change Type %

Activate Graphic Entity

Graphic Percent Change %

Graphic Price Change Type %

Entry Time

Exit Time

Buy Entry Daily Time Long Exit Daily Time

Sell Entry Daily Time Short Exit Daily Time

Scheduled Long Profit %

Scheduled Short Proft %

Squeeze Momentum Volatility Booster

Use Bullish Engulfing Candles (For Buy)

Use Bearish Engulfing Candles (For Long Exit)

Use Bearish Engulfing Candles (For Sell)

Use Bullish Engulfing Candles (For Short Exit)

Use Swing Low Candles (For Buy)

Use Swing High Candles (For Long Exit)

Use Swing High Candles (For Sell)

Use Swing Low Candles (For Short Exit)

Pyramiding %

Conditional Pyramiding

1st MA Pyramiding

2nd MA Pyramiding

3rd MA Pyramiding

4th MA Pyramiding

5th MA Pyramiding

Pyramiding %

Conditional Pyramiding

1st MA Pyramiding

2nd MA Pyramiding

3rd MA Pyramiding

4th MA Pyramiding

5th MA Pyramiding

Activate Manual Long Take Profit %

Long Take Profit %

Activate Manual Long Stop Loss %

Long Stop Loss %

Activate Indicator Long Stop Loss

Indicator Type

Activate Trailing Long Stop Loss %

Long Stop Loss %

Activate Progressive Long Take Profits

TP 1 % Contract1 %

TP 2 % Contract2 %

TP 3 % Contract3 %

TP 4 % Contract3 %

Activate Manual Short Take Profit %

Short Take Profit %

Activate Manual Short Stop Loss %

Short Stop Loss %

Activate Indicator Short Stop Loss

Indicator Type

Activate Trailing Short Stop Loss %

Short Stop Loss %

Activate Progressive Short Take Profits

TP 1 % Contract1 %

TP 2 % Contract2 %

TP 3 % Contract3 %

TP 4 % Contract3 %

Activate ATR Trailing Stop

ATR Length

Use ATR Structure

How far to look back for high/lows?

ATR Multiplier

Low Price

High Price

Grid Level Count

Grid Stop Price

Activate Long Grid

Activate Stop Grid

Investment Frequency

Activate Algo Investing

Activate Backtesting

Block Before Time

Block Buy Before Time Block Long Exit Before Time

Block Sell Before Time Block Short Exit Before Time

Block After Time

Block Buy After Time Block Long Exit After Time

Block Sell After Time Block Short Exit After Time

Long Entry Alert Signal

Long Entry Pyramiding Alert Signal

Long Exit Alert Signal

Short Entry Alert Signal

Short Entry Pyramiding Alert Signal

Short Exit Alert Signal

Start Date

End Date

Why Do Thousands of Traders Choose Uzmandata?

Leave the stress of manual trading behind.

Here are the features that will change your trading life:

Extensive Indicator Library

RSI, MACD, SuperTrend, and more. Professional indicators are waiting to be part of your strategy.

24/7 Market Monitoring

No need to keep your computer on. Your strategy runs 24/7 via TradingView Server-Side Alerts while you sleep or travel.

First Test, Then Invest

See the historical performance of your strategy before risking real money. Backtest unlimited times.

Zero Coding, 100% Control

No need to know Python or Pine Script. Build complex algorithms just by checking boxes.

Seamless TradingView Integration

Run your strategies smoothly with real-time data on the world's most popular charting platform.

1-on-1 Expert Support

You are not alone. Our technical team is ready to assist you with setup and technical configuration.

One Package, Unlimited Access

Get both the Strategy Indicator and the Automated Trading Integration in a single package. Join now and lock in all future updates at no extra cost.

$1997

everyday price

$997

/ One-Time

Pay once, use forever.

Ultimate Strategy Indicator (Unlimited Backtest)

Automated Trading Compatibility (Crypto & Stocks)

TradingView Alarm Integration

24/7 Execution via TradingView

Priority Support & Free Updates

🔒 256-Bit SSL Secure Payment

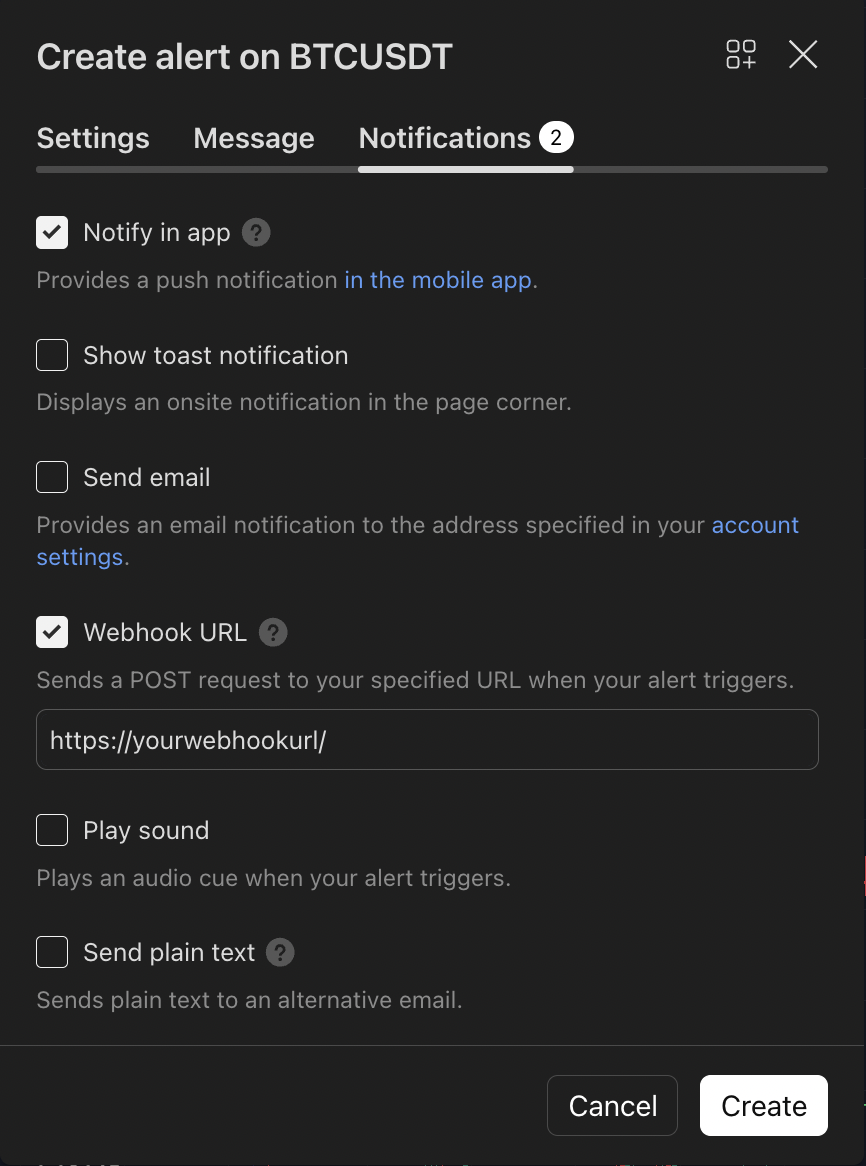

Turn TradingView Signals into Real Orders

Set up your strategy, copy your unique Webhook URL into the TradingView alert box. That's it!

The moment a signal is generated, your order is transmitted directly to your exchange account via TradingView integration. While you go on with your life, your system stands guard 24/7 in Crypto and Stock markets.

Audit Every Single Trade

Go beyond the charts. Review a transparent list of exactly when and at what price your strategy executed trades.

Verify all entry and exit points and leave no room for surprises.

Get Opportunities as Notifications

Stop staring at the screen. Get an instant Notification the moment your strategy generates a signal. Never miss a market move.

Combine Indicators, Create Your Own Signal

MACD, RSI, or Stochastic... Connect different indicators to each other.

Instead of writing complex code lines, simply check the boxes on the panel to define your conditions. Build your strategy in seconds, just like assembling building blocks.

Stop Guessing: Real-Time Profitability Analysis

Watch the chart and profitability rate change live as you tweak your strategy settings.

Discover which parameters make money and which ones lose money before risking a single penny.

Frequently Asked Questions

When you purchase, the premium "Ultimate Strategy - Uzmandata" indicator is added to the TradingView -> Indicators -> Invitation-Only Access section.

You are registered to our training panel.

The strategy indicator works entirely on TradingView's free plan.

The strategy indicator is available on TradingView for stocks, crypto, forex, futures, and commodities such as 1min, 5min, 30min, 1hr, 4hr, 1day, etc. It works in all time frames including.

Indicators within the strategy indicator can fit any type of position (scalping, swing trading, investment, etc.) according to their algorithmic calculations to find the right trading points.

No way. There is no “indicator,” “algorithm,” “system,” or “strategy” that will give you the power to predict the markets with guaranteed accuracy.

Premium indicators cannot guarantee you profits or make you a better trader / investor on their own.

We do not recommend that you follow any indicator blindly. Trading is risky, most traders lose money and past performance does not guarantee future results.

The difference of the strategy indicator is that it prevents emotional behavior and enters into transactions by receiving buy or sell signals from more than one indicator.

You still choose which indicators you will get support from.

For now, our indicators only work on TradingView (a free web-based charting platform) and you can trade based on these charts in real-time on those charts.

Automate Your Trading Today

Leave the stress and emotional decisions behind. Trust the data, and let your automated strategy execute trades 24/7 with discipline.

Ⓒ 2026 Uzmandata LLC

Privacy, Cookies & Refund Policy | Terms of Service | Disclaimer

Uzmandata is not a brokerage. Financial datas provided by TradingView.